The Ukrainian petroleum products market is undergoing a profound structural transformation. This threatens the stability and future development of micro, small, and medium-sized businesses (MSBs). The number of independent operators is shrinking, while large chains are strengthening their presence. In this context, it is crucial to clearly define the key risks and scenarios for future developments.

Current Dynamics: Market Contraction

- Decline in numbers: Over the last three years, the number of gas stations has decreased by 22%—from approximately 7,700 to 6,000 stations.

- Reduced sales: In 2024, the volume of petroleum product sales fell by 23% compared to 2021 and by 2.4% compared to 2023.

- Sales drop: In the first half of 2025, a 7% drop in sales was recorded, which negatively impacts the revenue and profitability of small operators.

A key risk remains the further increase in excise taxes until 2028, which could accelerate the exit of the most vulnerable companies from the market.

Main Factors of Regulatory and Market Pressure

- Excise Policy: The phased increase in excise tax rates significantly reduces profitability.

- Advance Corporate Income Tax Payments: Monthly obligations have become a significant financial burden. According to the State Tax Service, in 2025, hundreds of licenses were revoked due to non-payment of advance payments, and about 20% of small operators ceased operating in the legal sector.

- Resumption of Inspections: As of January 1, 2025, scheduled fuel quality inspections are in effect. The average fine of UAH 20.7 million is critical for small stations.

- Market Consolidation: The decline of independent stations is accompanied by a redistribution of customer traffic towards large chains, increasing the risks for MSBs.

- Energy Transition: The growing share of electric vehicles in the transport sector is reducing the demand for gasoline and diesel. Large chains are integrating charging stations, while this remains economically unfeasible for small gas stations.

- Logistical and Military Factors: Disruptions in fuel supply and unevenness in regional markets increase the vulnerability of independent operators.

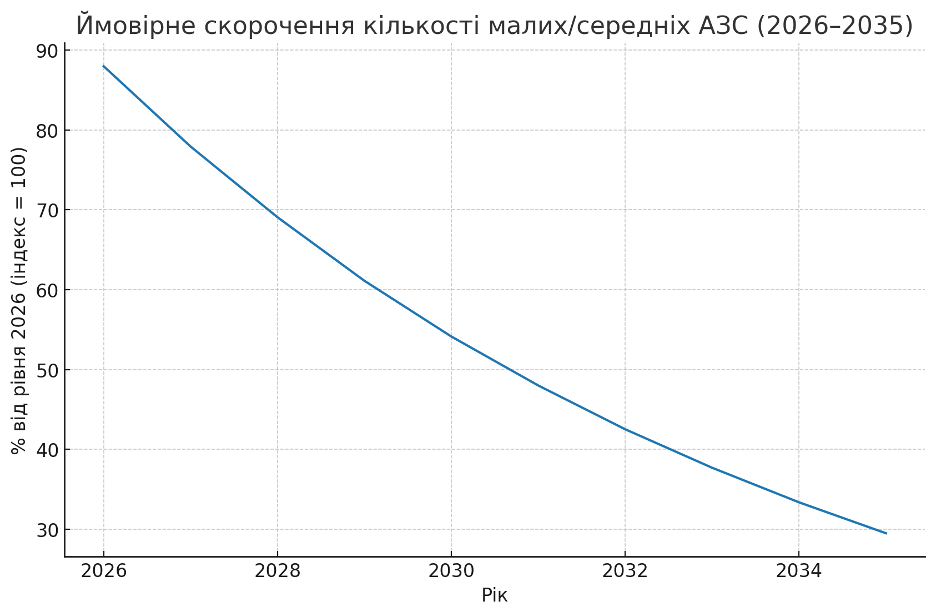

The Future at Stake: A 10-Year Forecast

Our analysis shows that there are no “safe” paths for MSB-owned gas stations. Based on a baseline scenario that considers current trends, we predict that by 2035, the number of independent stations could decrease by approximately 70%. This means that of every 100 gas stations operating in 2026, only 30 will remain.

- Single Gas Stations: The projected decline is from approximately 960 to 280 stations (−70%).

- Small Chains (2–10 stations): The projected decline is from approximately 1,580 to 460 stations (−70%).

- Medium Chains (11–50 stations): The projected decline is from approximately 2,000 to 590 stations (−70%).

These figures are not just statistics but a clear signal: the market is changing, and inaction will cost you your business.

Nobody can guarantee the future, but it is possible to see the trends. Instead of passively observing the market contraction, you should realize that your business is at risk. Don’t wait for changes to force you out of the market. Act now, so your business doesn’t become part of a grim statistic.