The Fuel and Energy Business Association (FEBA) and leading analytical centers conducted a consolidated analysis of structural shifts in the retail petroleum products market. The study confirms a significant increase in market concentration, resulting from a combination of military, economic, and fiscal factors.

This trend creates a new landscape for all market participants—from producers to end-consumers—and demands attention from regulatory bodies to preserve price stability and ensure industry sustainability.

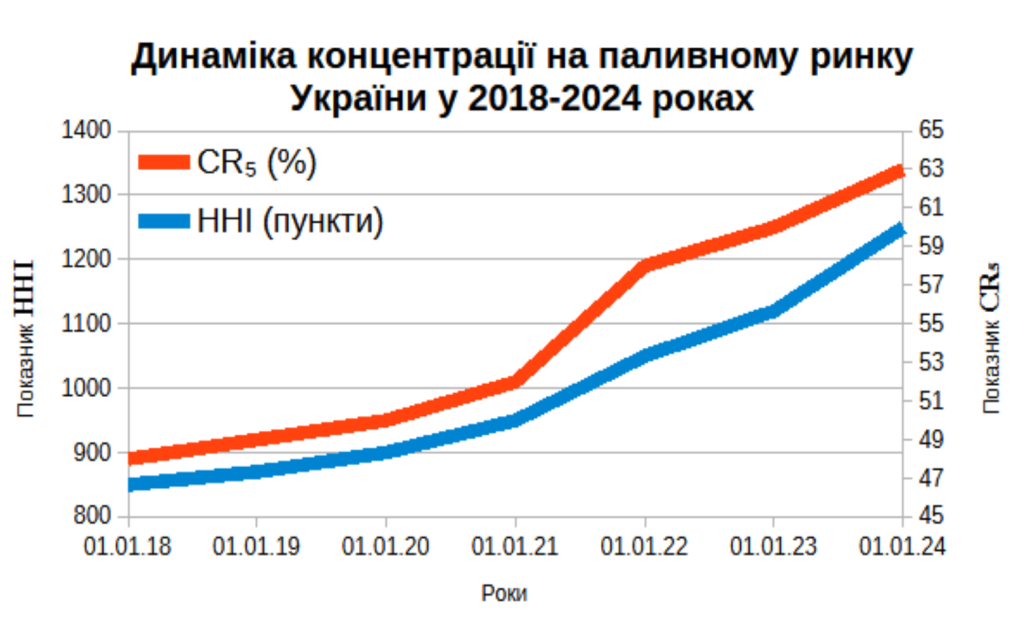

Cardinal Structural Shifts: Monopolization in Figures

Since 2022, the fuel market has faced unprecedented changes, leading to a shift in the balance of power and the consolidation of market power:

- Critical Concentration Growth (HHI Index): Calculations using the Herfindahl-Hirschman Index (HHI) recorded a 47% increase in market concentration in the petroleum products market. This is a direct economic indicator that the influence on pricing and distribution has significantly increased among a small group of the largest operators.

- Consolidation of Financial Flows: As a result, only 17 companies now receive over 50% of all retail market revenues. This confirms a significant concentration of financial resources, which strengthens their stability but simultaneously reduces overall market maneuverability.

- Loss of the “Price Anchor”: Historically, a key operator (discounter) functioned as the “price anchor,”restraining the general price level. Its disappearance has allowed the “premium” segment to increase the average markup on branded fuel.

Multi-Factor Impact: Causes of Concentration

The growth of concentration is a complex, multi-factor process where military and economic factors overlap with regulatory decisions:

Military and Economic Factors

- Logistics Destruction: Military actions destroyed logistical hubs and internal capacities. This led to a 90% reorientation of imports from the EU (so-called “from the wheels” trade).

- Advantage of Resource Giants: In these unstable conditions, companies with larger financial reserves and an extensive logistical infrastructure gained an advantage in ensuring uninterrupted supplies.

- Reduced Volumes: The decrease in overall consumption volumes (due to migration and economic downturn) intensified the struggle for market share, also contributing to the displacement of weaker players.

Tax Component

- Increased Tax Burden: The rise in excise tax increased the proportion of taxes in the fuel price structure.

- Disproportionate Fiscal Pressure: The fixed monthly advance corporate income tax payment creates a disproportionate burden on small and medium-sized businesses (MSBs). For companies with low sales (regional discounters), this fixed payment undermines financial stability, accelerating their exit from the market.

Forecast and Consequences: Risks for Business and Consumers

Analysis of the current situation states significant risks that could materialize in 2026 if regulatory measures are not taken:

| Risk | Impact on Market and Business | Consequences for the End-Consumer |

| Increased Price Dictate | Given the high concentration (HHI growth), the premium segment gains greater opportunities for coordinating pricing policy and using market power. | Elimination of the price restraint mechanism. Fuel prices become less dependent on global quotes and more on the internal pricing policy of market leaders. |

| Inflationary Pressure | The displacement of MSBs leads to the disappearance of the cheapest assortment and raises the price floor for all brands. | Direct risk of “fueling the inflationary spiral,” as fuel is the main element of the cost of most goods and services. |

| Growing Income Gap | Concentration allows large players to monetize their infrastructure more effectively. The income gap between premium and other networks will increase. | Reduced fuel availability in remote and rural communities due to the closure of local gas stations that could not withstand competitive and fiscal pressure. |

Preserving a competitive environment is critical for macroeconomic stability. This requires a balanced fiscal design that does not create disproportionate pressure on MSBs, as well as strengthened anti-monopoly monitoring to prevent the misuse of market power. FEBA calls for dialogue to form fair rules of the game that benefit the economy and citizens.